OUR TEAM

It Takes a Team

GET INVOLVED WITH VETEM FOUNDATION

Join our community of fundraisers.

What Your Donations Does

What The VETEM Foundation Do

The Foundation helps fund its Housing Initiative through fundraising efforts, government grants,

and generous donations. These donations help us provide home ownership opportunities for

our men and women in uniform who continuously put their lives on the line so we may have

freedom.

We at VETEM Foundation believe with conviction, that those who had put and are putting their

lives on the line to serve and protect our nation deserve not just gratitude, but appreciation

through action.

Our unique Housing Program provides both homeownership and financial wealth and

independence through rental income, guaranteeing their futures.

Our Housing Program

Our Housing Process

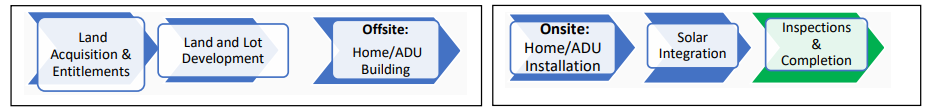

Our Home Building Process

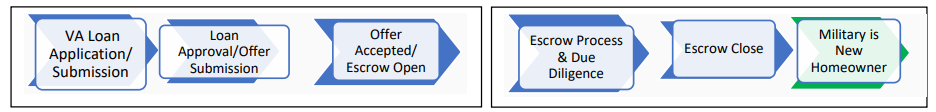

Home Buying Process

Apply For Housing

Our housing Program provide not only secure housing but also a pathway to lasting economic

wellbeing, sustainability and stability for militaries and their families.

These solutions provide them with opportunities for financial growth, ensuring they have the

resources they need to thrive long term.

Applying For a Loan

Key Tips:

• Do NOT make major financial changes before considering applying for a home loan

• Don’t open new credit cards, take out a car loan, or make large, unexplained deposits into your

bank accounts.

• Shop around, don’t just go with the first lender you find. Compare rates and fees.

Getting Started

1. Check Your Financial Health:

o Credit Score: Lenders use this to determine your interest rate and eligibility. A higher score

gets you better rates. Obtain a copy of your credit report from all three bureaus (Equifax,

Experian, TransUnion).

o Debt-to-Income Ratio (DTI): Most lenders prefer a DTI below 43%. Calculate your monthly

debt payments (car loans, student loans, credit cards) divided by your gross monthly income.

o Savings: Ensure you have enough for a down payment (typically 3%-20% of the home’s

price) plus closing costs (typically 2%-5%).

2. Get pre-approved:

o A pre-approval is a lender’s conditional commitment to loan you a specific amount based on

a verified review of your finances (credit, income, assets).

o Why it’s crucial: It shows real estate agents and sellers that you are a serious, qualified

buyer. It makes your offer much stronger in a competitive market. We recommend getting an

underwriter’s approval rather than just a lenders pre-approval letter.

o What you’ll need: W-2s, pay stubs, bank statements, and tax returns for the last two years.

o Result: You receive a pre-approval letter stating the loan amount you qualify for. It is best to

get underwriter approved.

Fixing Your Credit

About Credit Scores:

FCRA, the Fair Credit Reporting Act, requires creditors to furnish you with a free copy of your credit report

upon request. You are entitled to one free report per week from each bureau, (Equifax, Experian, TransUnion).

Lenders use this to determine your interest rate and eligibility. A higher score gets you better rates.

What To Do

1. Get your free official credit report: from all three bureaus (Equifax, Experian, and TransUnion.

Go to www.AnnualCreditReport.com). This is the only officially authorized site.

2. Check Your Reports for Errors: Go through each report line by line. Look for:

o Incorrect Account Information: Accounts that aren’t yours, incorrect balances, or wrong

credit limits.

o Inaccurate Negative Items: Late payments that you believe you paid on time.

o Outdated Information: Negative items that are more than 7 years old (or 10 years for

some bankruptcies). They must be removed by law.

o Duplicate Accounts: The same debt listed multiple times, especially in collections.

o Inquiries You Don’t Recognize: Hard inquiries from lenders you never applied to.

3. Dispute Errors with the Credit Bureaus:

o For each error you find, file a formal dispute in writing with the specific credit bureau

(Equifax, Experian, TransUnion). You can often do this online, but sending a certified mail

dispute letter is often most effective.

o Be specific: Clearly identify the item, state why it is inaccurate, and request its deletion or

correction. Include copies (NOT originals) of any supporting documents.

o The credit bureau then has 30-45 days to investigate your claim by contacting the data

furnisher (the lender/collector).

4. Dispute Directly with the Furnisher:

o You can also send a dispute letter directly to the company that provided the inaccurate

information to the credit bureau (e.g., the bank or collection agency).

o This creates a second line of attack. If the furnisher confirms the information is wrong, they

must notify all three credit bureaus to correct it.

5. For accurate negative items (like collections accounts):

o If the negative item is legitimate, your best strategy is often a “Pay-for

Delete” negotiation.

o Contact the collection agency and offer to pay the debt (or a settled amount) in

exchange for them completely removing the collection account from your credit reports.

6. Establish Positive Payment History:

o Your payment history is the biggest factor in your FICO score (35%), so, pay every bill on

time, every time.

o Set up autopay for at least the minimum payment to ensure you’re never late.

7. Lower Your Credit Utilization:

o This is the second most important factor (30%). This is the ratio of your credit card

balances to your credit limits.

o Aim to keep your utilization below 30%, and ideally below 10%.

o You can lower it by paying down balances and/or asking for credit limit increases (but only

if you aren’t tempted to spend more).

8. Become an Authorized User:

o Ask a family member with a long, positive credit history and low credit card balances to

add you as an authorized user on their account. Their good history can be imported onto

your credit report.

9. Consider a Secured Credit Card:

o If you can’t get a traditional card, a secured card (where you make a cash deposit as

collateral) is an excellent tool to build positive payment history.

• Credit Repair Scams: Any company that guarantees to erase accurate negative

information, asks for payment upfront, or tells you not to contact the credit bureaus

directly is a scam. (This is what the earlier “FIO SORE” strategy falls under).

• Disputing Accurate Information: Filing frivolous disputes on items you know are

accurate is a waste of time and can be considered fraudulent.

• “Credit Sweeps” or “New Identity” Schemes: These are illegal and can result in

serious penalties.

“Credit Cleaning” Process: What to AVOID

The real “FICO cleaning process” is a methodical legal strategy of:

1. Identifying and disputing inaccuracies in your reports.

2. Negotiating the removal of accurate negatives where possible (Pay-for-Delete).

3. Building new, positive credit habits to outweigh past mistakes.

This is not a quick fix, but with diligence, it is the most effective way to genuinely improve your

financial standing and your FICO score.

The Effect of Your Financial Behavior on Your Credit

OUR TEAM

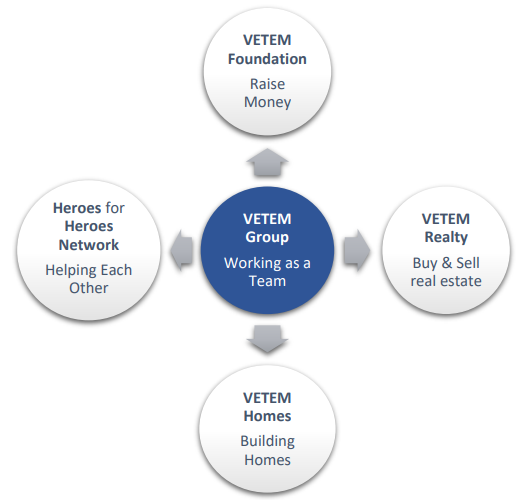

VETEM Foundation. The fundraising Arm of the VETEM Group, led by women for

heroes. This includes high ranking retired women military generals bringing a wealth

of knowledge to the table. The foundations raise funds to support its Housing Initiative

in providing owner-occupied residential income housing to financially support the long

term economic stability of militaries, veterans, and military their families.

The HEROES for HEROES Hub

A national military-exclusive

network bridging talent,

expertise, and opportunity,

uniting active-duty service

members, veterans, spouses,

and military families.

Showcasing Skills – Highlight

their professional expertise

beyond service. Forging

meaningful Connections –

Collaborate with like-minded

professionals. Launching

Ventures – Explore

entrepreneurship with trusted

support

VETEM Homes. The home

builder Arm of the Group.

Building affordable and

sustainable housing solutions

for our military and their

families. Connecting military

families with expert military

real estate professionals and

lenders to assist with their

housing needs as they better

understand the unique needs

of the community

VETEM Realty. The real estate brokerage Arm of the Group, serving as both

the Buyer and Seller in real estate transactions to ensure seamless, guaranteed

transactions. Handing over the homes to VETEM Homes for renovations and ADUs

additions, then selling the primary homes only to qualified military homebuyers. The

ADUs are donations from the VETEM Foundation. Our unique model provides speed,

deal-certainty, competitive offers, and structured support backed by the strength

of the VETEM Group.